Blocking of equity scrips falling under surveillance measures from placeorder API from Friday 24th Jan, after market hours

-

The Exchange has introduced guidelines requiring Brokers to display applicable surveillance measures on a scrip before order placement and to obtain client consent for order execution.

Since this functionality cannot be provided for SmartAPI, we have decided to block all such scrips from the placeorder API starting Friday January 24,2025, after market hours. This change will only impact scrips under surveillance measures in the equity segment, and will not affect F&O or commodity segments.

If an order is placed for one of these scrips, the following error message will appear: "The order cannot be processed as the token is categorized under cautionary listings by the exchange." The order will not be executed.

Please find the link to circular - https://nsearchives.nseindia.com/content/circulars/SURV64402.pdf

Users can alternatively trade in such securities via our mobile/web application.

-

It is not just for ESM, but there are many other categories as well.

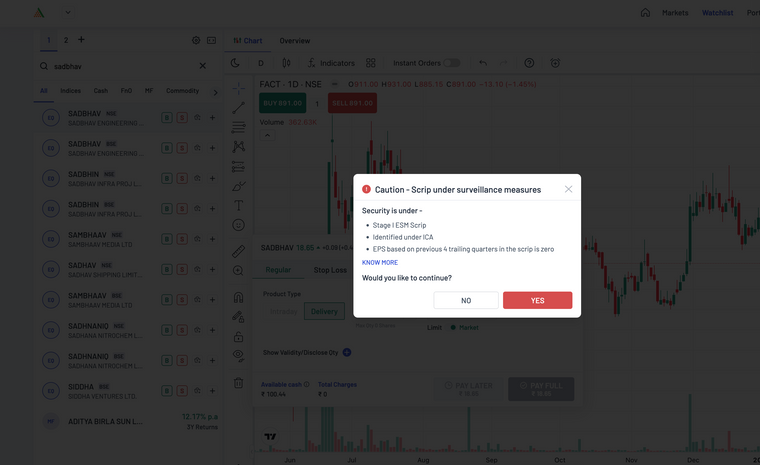

We have blocked the scrips in API because the exchange mandates that a 'pop up is shown before the trade is placed' and user submits their 'consent everytime the pop up is being shown'.

The pop up cannot be shown in APIs, also, since users automate their trades, the consent cannot be automated.

The you can trade in those scrips via web and app as the pop up and consent can be taken there.

Since you have given an example of ESM scrip, here is the pop up and consent undertaking for an ESM scrip on the web.

The above image is for a scrip falling under ESM today, at 30th Jan 2025 - SADBHAV-EQ

-

How can I get which stocks are under surveillance measures? so that I can add some logic in API.

-

@admin This completely goes against the very concept of an API! I built an algorithmic trading platform to handle trade entries and exits automatically, and now, because of this change, I have to manually check for failures and exit all my trades myself. How is that supposed to be good design? Can you provide some additional API or the Parameter to Override a value as Yes which is considered similar to App for the Exit of trades alone? So that I wont face this issue.

-

Ex: you told me that when script is under ESM, NSE ask broker to show Pop up for same.

Since you mention it can not be done for APIs, it stopped. ( ok I agree)

But at same time it also not poping up on Mobile App ( why not banning script via Mobile app)

Let me rise this isse with your team first here.

or i have to approch exchnagea. ( please enlighten me, if i m missing something)

Moreover, being broker you cant say we xan add pop on APIs- and blocking then whats purpose of Being broker it self. You can only show Pop up, bloxking script is crime and giving partial tritment to retailer due to lack of Technology

-

@pavi-jun2 We regret the same, you can exit the trade by using the app / web platforms.

-

Hi Sir,

I understand issue with blocking the orders for new orders. But why orders are blocked for cover orders? Today all my API calls failed for many of the stocks which were suppose to close with SL Set at my program. How should I exit a trade which I already entered few weeks or months back?

Regards,

Pavithra -

@admin when it can be unblock for such stocks?

-

@mihirshah2500 The orders are blocked only for the stocks that fall in the cautionary messages given by the exchanges, which was to be done to comply with the regulations.

The placeorder API is working for other stocks, as well as F&O and commodities.

-

- Why were such drastic changes implemented without any prior notice? At the very least, a month's notice should have been given to allow users to adapt.

- What’s the purpose of SmartAPI if it no longer supports order placement via API? It’s disappointing that customer concerns don’t seem to have been raised with the exchange, showing a lack of empathy for your users.

Please confirm if SmartAPI is no longer a solution for API-based execution so we can explore alternative brokers/APIs accordingly.

-

@admin But how will we place orders on days when the website and phone app are down? Something has to be thought out.