AngelOne RMS is unable to quickly adjust margins for spreads!

-

@admin @Moderator_1 @Moderator_2

Hi folks,

Please explain in which way the RMS system in AngelOne works?

Consider a simple Calendar spread - a near PUT sell, a far PUT buy.

Approx margin required is Rs.30000 for the whole spread.Situation 1:

When I want to sell the near PUT, if I have already bought the far PUT, do I get the margin benefit?

That is will the order execute if I have 30000 in funds, instead of the naked PUT sell margin of RS 1,20,000 approx.or Situation 2:

When I want to sell the near PUT, I MUST have the full margin available (Rs. 1,20, 000 approx), regardless of the the previous far PUT (hedge) being bought or not?Please confirm!

Note: In Zerodha, this margin benefit is automatic. That is, it happens like in situation 1. If I have bought my hedge beforehand, I get full margin benefit during my sell leg.

-

Hello @projectSB,

As per your description, Situation one is applicable the way Angel One RMS System works.

Thank you.

Regards

SmartAPI Team -

@Moderator_1 In that case, it seems that the RMS is

- Holding much more amount than the margin required! For example, this is what your margin calculator shows:

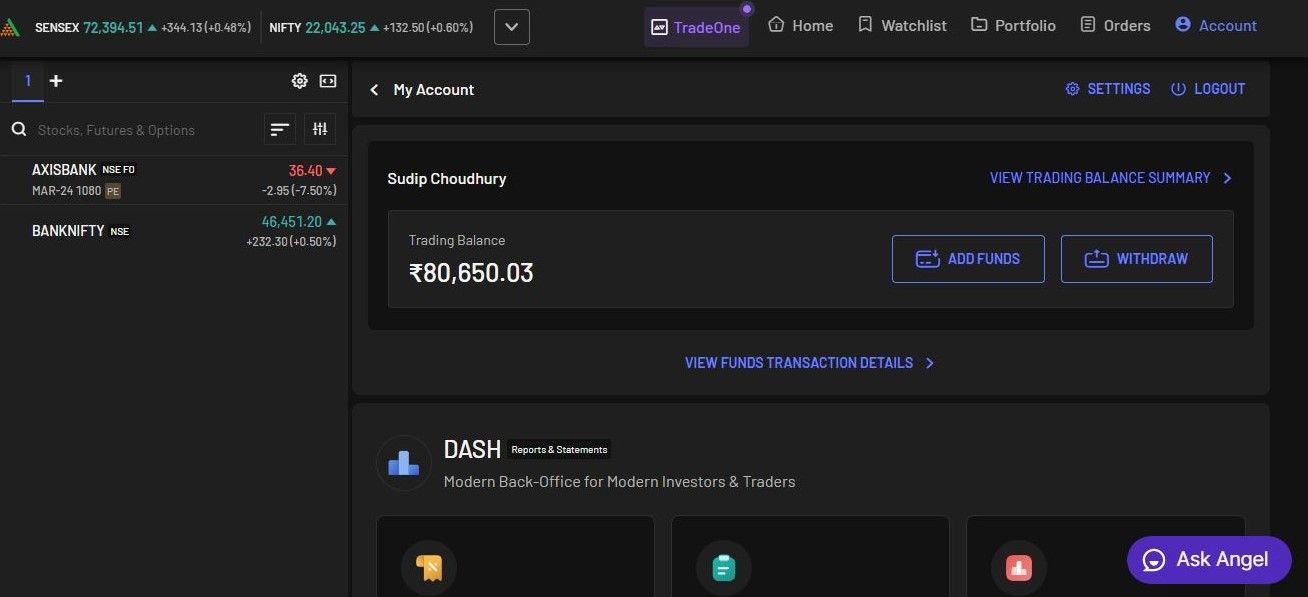

And this is what was left in my usable funds when I was trading the same setup:

I have around 1.47 lakhs as funds, and during the trade I had around 80000 remaining, so approx 70000 was captured as margin (55% more than what's shown!)!

Check my order and trade history for today, and you will be able to verify. Client code: S382492

- And secondly, in real time, this margin captured is even more! Meaning if I have to place 4 orders simultaneously the RMS is slow in getting the actual hedged margin.

-

@Moderator_1 And also note that, I always trigger BUY orders, wait for its completion and then trigger SELL orders to get the margin benefits. FYI

-

@projectSB I'll get it checked with tech and get back to you on this.

Thank you.

Regards

SmartAPI Team -

@Moderator_1 Hello, what is the update on this issue?

Also, please mention if there is any difference in INTRADAY margin vs CARRYFORWARD margin. If yes, then by how much?

Or you can use current week's Nifty ATM options to get the answer.You can use the example mentioned in the screenshot itself. I don't think that we get any leverage in FNO trading from AngelOne. Please confirm. In that case we will use only CARRYFORWARD orders.